Do you want to gain interest in your asset by staking your cryptocurrency? There are many platforms that provide services for this. In today’s content, you will have the chance to review a detailed review of Venus.io with the privilege of CrytoShift. In the content, both the services offered by the platform and the terms of service were evaluated objectively. If you’re tired of thinking about the answer to the question “is Venus.io scam or real?”, it’s time to breathe a sigh of relief. Here is the answer to everything.

KEY TAKEAWAYS

- Venus.io is a platform that enables users to trade, lend, and borrow with stablecoins, cryptocurrencies, and other digital assets.

- VAI is a token built on the Binance Smart Chain and backed by other stablecoins without any central control point.

- The native token of the platform is referred to as XVS. To ensure a fair environment, pre-mining the token by team members, consultants, or the foundation itself is prohibited

- At Venus.io, consumers’ investment processes against collateral stand out, especially with their low cost and very fast transaction

- The critical comments about Venus.io emphasize the fact that users cannot borrow XVS via the protocol.

- Venus protocol allows users to supply assets to gain interest income, farm assets, borrow assets to gain instant liquidity, and mint XVS.

Before moving on: Do not forget to have a look at Beefy.finance review before start investing.

Table of Contents

What is Venus.io?

Venus.io is a platform that enables decentralized digital assets trading, facilitating lending and borrowing with stablecoins, cryptocurrencies, and other digital assets. It is possible to generate passive income with your crypto assets by trading with VAI, the first decentralized stablecoin in the world. One of the main differences of Venus.io is that, unlike other popular DeFi platforms, it is not built on the Ethereum blockchain, but on the Binance Smart Chain.

The protocol also allows users to mint VAI stablecoins by sending at least 200 percent collateral to the Venus smart contract. Minting VAI is preferable among participants because of low transaction fees, instant transactions, and the promise of high transparency.

What is VAI Token?

VAI is a token built on the Binance Smart Chain and backed by other stablecoins without any central control point. They also can be defined as synthetic BEP-20 tokens pegged to the value of one US dollar. VAI aims to enable users to perform lending, borrowing, and mint transactions in a transparent environment with high speed and low transaction fees.

- VAI is based on a vision that aims to make credit facilities and other transaction options in the financial world accessible to everyone in a fair manner without any borders.

- VAI, which can be held on Metamask and Binance Chain Wallet, is backed by Swipe, the Binance portfolio company. Swipe was found by Josesito Lizarondo.

- What makes VAI different is that the Venus protocol allows users to mint VAI on a 200 percent collateral investment in the Venus smart contract.

- At the time of writing this content, the market price of VAI is $0.9289. Also, its market capitalization is $53,414,029. Don’t forget to check the most up-to-date data.

The Venus Token

The native token of the platform is referred to as XVS, as a BEP-20 token. To ensure a fair environment, pre-mining the token by team members, consultants, or the foundation itself is prohibited. In order to purchase the token, it is possible to act as a liquidity provider to the pool or to participate in the project’s launch pool.

It is known that the Venus team has mined a total of 23,700,000 XVS in the past four years. It is possible to say that the average daily mining rate of the token is 18,493. Approximately one-fifth of the token’s total supply is used to back the Binance Launchpool program, with all the rest reserved for use in the protocol. Three-fifths of this eighty percent is reserved for borrowers and suppliers transacting on Venus Protocol. Two-fifths are reserved for funding for those who want to mint the stablecoin.

Where to Buy Venus (XVS)?

You can easily buy Venus on Binance. Although you cannot buy it directly in fiat currency, purchasing is possible through your Tether (USDT), Bitcoin (BTC), Binance Coin (BNB), and Binance USD (BUSD).

What Makes Venus.io Different? – Key Features of the Platform

At Venus.io, consumers’ investment processes against collateral stand out, especially with their low cost and very fast transaction. Therefore, those who want to trade with high amounts of assets often prefer to take advantage of this advantage. The features that make the platform different are as follows:

| No KYC policies Every user can transact in lending and borrowing processes of digital assets without any credit check steps. There is no need to share personal data known as Know Your Customer (KYC). Instead, participants can interact with Venus DApp and complete their financial transactions very quickly. This decentralized and credit check-free ecosystem allows anyone to access DeFi products without restrictions on geographic region, citizenship, or financial history. |

| Pool & Security All of the crypto money-based loans received on the Venus.io platform are provided from the liquidity pool created by the contributions of Venus.io users. Liquidity providers are rewarded with advantageous APY rates. In order to ensure the security of financial transactions realized on the platform, over-collateralized deposits made by borrowers are used. |

| Transparency and fairness The protocol is funded by its native token. This token is a stablecoin, VAI, and its core operating principle is based on transparency and fairness. |

| Anti-manipulation Venus protocol leverages price feed oracles to minimize market manipulation. These oracles also include those from Chainlink. Although it achieves wide access to price feed oracles, the overall cost footprint of the platform is not high because Binance Smart Chain enables access to relevant data with a low consumption. |

| Yield farming On the platform, users deposit stablecoins and digital assets correlatively. In return, they earn passive income and perform yield farming. |

| Quick mint & valid collateral The platform that allows quick mint from collateral is also advantageous for new investors in this regard. In addition, the collateral on the platform is accepted for use at many points globally. |

| Fast transaction & low fees As a reward for being built on Binance Smart Chain, it is possible to say that the transaction fees on Venus.io are quite low and the transaction speed is high. The algorithm, which performs transactions almost “instantly”, is a real-time source of liquidity, especially for Bitcoin (BTC), XRP, Litecoin, and many more cryptocurrencies. This real-time processing power finds an instant solution to the needs of users who want to access lending. |

What Problems Does Venus Claim To Solve In The DeFi World?

Underlining that it solves the problems in DeFi protocols on the Ethereum Blockchain, Venus points out the following disadvantages in particular:

- Platforms that do not have a user-friendly interface

- Low transaction speeds

- Very costly transactions

- Centralized compound interest rates

- Lack of high market capitalization

Fast Review: Most Popular Positive and Critical Highlights About Venus.io

By doing a general search on the internet, we searched for real user reviews about Venus.io. In the light of these, we have brought together the most popular positive and critical comments. Before going into details, check out these highlights from a bird’s eye view:

| Positive Comments | Critical Comments |

|---|---|

| 3-second almost-instant transactions | No mobile app is available |

| Most popular protokol on BSC | Liquidity modules are criticized to be vulnerable |

| Low fees per transaction | Doesn’t allow to borrow XVS |

| Token minting rewards | Over-collateralized architecture may be a disadvantage for extremely high volumes. |

What Can You Do on Venus Protocol?

Venus Protocol has many financial functions that you can take advantage of. If you wish, you can deposit your digital assets and earn APY for it. If you wish, you can borrow crypto money by accessing instant liquidity via Venus protocol. In the protocol, which also allows you to make minting, a 200 percent collateral investment to the smart contract is sufficient. The protocol allows you to mint VAI with high speed and low cost.

Venus.io – Supplying Assets & Gaining APY

Venus Protocol allows participants to earn on interests by supplanting many cryptocurrencies such as Venus (XVS), USD Coin, BNB, XRP, and LTC to the platform. The deposited liquidity is used as collateral for loans within the platform.

Supplying assets to Venus Protocol by users helps to increase the security of collateral within the ecosystem by increasing the participants of the protocol. The liquidity supplied by the users is directly connected with smart contracts. In this way, users can withdraw their liquidity at any time when the protocol total balance is positive. It also allows participants to become lenders. Users can earn interest at varying levels according to the market conditions of the cryptocurrency they supply. The demand for the locked money directly affects the interest values.

Providing crypto money supply to Venus Protocol provides users with token incentives. The earned synthetic token is a v-wrapped version of the deposited token. For example, when the user deposits Ether on the platform, he receives cETH. The only tokens that can be used to redeem the underlying asset on the platform are cTokens. While locking their assets, users can save their wrapped tokens in any wallet that supports Binance Smart Chain by redeeming the protocol. In this way, while they earn passive income through interest, they also keep their assets safe. Also, remeeded tokens can be used to trade with other tokens.

How to Supply Assets to Gain Interest on Venus Protocol?

If you want to supply any asset to Venus Protocol, first connect your wallet to the platform. Only in this way can you access the relevant interface. The things you will see in the interface are the Supply and Borrow markets in the lower right, as well as the VAI minting tab. The Supply Information section you see in the upper right is an area where you can view the amount of APY you have earned through the crypto assets you supply to the platform.

Are these fields currently showing no value? Then it’s time to do your first supplying. For this, follow the steps below:

- First, go to the Supply Market. Here you will see 25 different crypto assets. This number may have even increased since the date the article was written. Click the asset you want to supply.

- For you to supply this asset, the platform needs to interact with your wallet and get your approval. This is also subject to a gas fee. Do not be bothered by the expense you will pay for this part, because it is really a small amount. But remember that since you are trading on Binance Smart Chain, BNB will be requested as a gas fee, so you need to have some BNB in your wallet.

- After connecting with your wallet, specify the amount you want to supply.

| It’s that simple. Venus Protocol does not use any intermediaries for this process. Assets go straight from your wallet to the liquidity pool. The interest you earn will appear directly in your account as an increasing balance. Moreover, you have full control of your assets, you can withdraw your balance at any time via Binance Smart Chain. |

Venus.io – Borrowing Assets & Gaining Instant Liquidity

Users can borrow any cryptocurrency, stablecoin, or digital assets supported via Venus Protocol. For this, all users have to do is pledge the collateral that will be locked in the protocol. The digital assets to be borrowed must be over collateralized. In this case, a loan transaction can be made at the rate of seventy-five percent of the collateralized value.

Each of the assets in the liquidity pool of Venus Protocol may have different collateral rates. These generally vary between 40% and 75%.

| CryptoShift Explains Let’s make a small example of the collateral system. If you want to borrow any cryptocurrency from Venus Protocol and you are going to provide BTC collateral for it, the situation is as follows: If BTC has a collateral value of 75%, you can borrow cryptoassets equal to 75% of the BTC value you own. You can take. For example, someone with 100 BTC can borrow 75 BTC. |

Tip: Be aware that a small gas fee will be charged for this borrowing process. However, we have to say that the transaction fees in Venus Protocol are quite low when compared to other platforms.

The borrowing system described above is called collateral mining for short. When users borrow an asset against the supply balance through this system, they never have to repay it, because they can continue to mint the token.

How to Borrow Digital Assets on Venus Protocol?

It is possible to borrow supported assets from Venus.io for any duration you wish. Your credit will be transferred directly to the wallet you define over the protocol and there will be no intermediaries. Learn how to borrow an asset from Venus Protocol step by step:

- To start the process, open your Venus.io account and click on the Borrow Markets tab. This will take you to the area where the assets you can access are listed.

- Select the digital asset you want to borrow. Remember: you cannot take a loan in the type of asset you deposited as collateral. The two need to be different units.

- Enter the amount you need for Borrowing. Remember, the maximum amount you can withdraw can be up to 75 percent of your deposit as collateral.

- Complete the process and log into your wallet.

- If you use the Safe Max button on the platform, you will automatically start borrowing assets up to 40 percent of your borrowing limit.

- That’s it, you’re done. If you want to repay your loan, which you can do for the entire loan or a part of it, simply click on the Repay Borrow tab.

How to Manage Your Borrowing Limit on Venus.io?

As we mentioned above, the factor that determines the limit you can borrow through Venus Protocol is the collateral. Each user has a borrowing limit according to the collateral factor determined for the digital asset deposited as collateral.

You can deposit all cryptocurrencies supported by the platform as collateral. However, different assets have different collateral rates and these rates may vary. As can be expected, the higher the collateral ratio of an asset, the more advantageous it is for you. Because it allows you to get a higher borrowing limit by depositing the same money.

Cryptoshift Explains

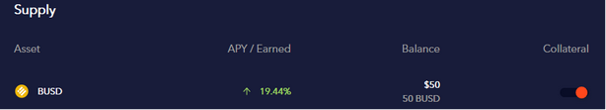

Let’s say you supply 50 BUSD with a collateral factor of 60 percent to the platform. In this direction, you have a borrowing limit of 60 percent of 50 dollars, that is, 30 dollars. Use the red button on the right to use the asset you supplied as collateral or to deactivate this feature of an asset used as collateral.

Venus.io – Minting VAI Stablecoin

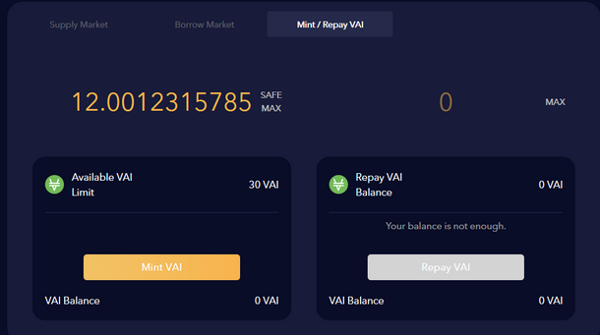

In Venus Protocol, it is possible to mint synthetic VAI stable coin by supplying 200 percent collateral. We will explain step by step what you need to do to start the process:

- First, log in to your account and click on the Mint / Repay tab.

- You will need to enter the amount you want to mint. If you use the Safe Max button, you will automatically set 40 percent of your Borrow Limit.

- Click the Mint button and that’s it, you’re done.

Interested in the area right next to the Mint? If you want to repay your VAI loan, first activate the asset via the protocol. In some cases, this method may make sense when you want to pay off your loan very quickly. Select the amount you want to pay and click Repay VAI. That’s it.

| Note that minting VAI is interest-free at the moment. But this may change in the future. |

Venus.io – Farming XVS Tokens and Voting Feature

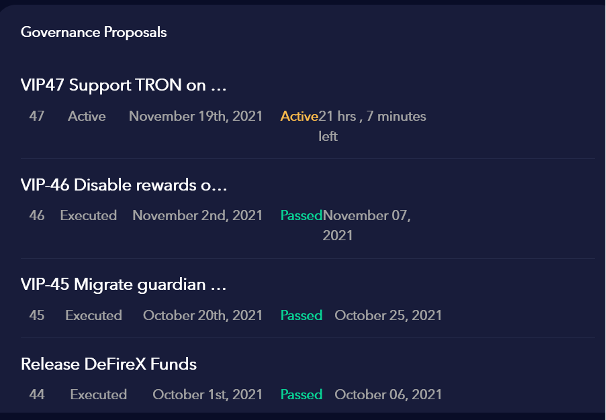

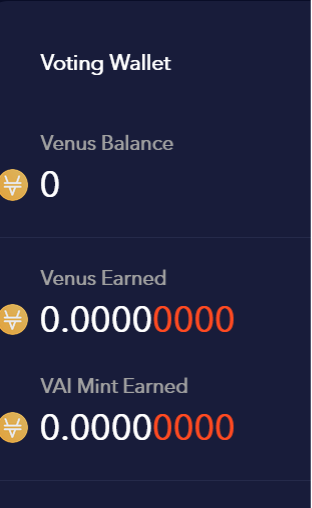

Users can farm XVS over Venus Protocol. XVS, also known as the government token, is distributed to users as a reward for using the protocol.

- Access the interface on the platform to get started. To do this, log in to your account and link your wallet.

- Then click the Vote tab. You can watch the farming activities from the Governance Proposals section here and you can request rewards.

- When you win Venus, it is written in the box on the right. To capture it, simply click the “Collect” button. When you complete the transaction, all your assets are transferred directly to your wallet without any intermediaries.

- If you wish, you can use your reward to benefit from another program on the platform. For this, for example, supply your XVS to the platform and have a borrowing limit.

Are There Any Risks Associated with Venus Protocol?

We know what everyone is primarily looking for on DEX platforms: Certik Audit. In this regard, you can breathe a sigh of relief because Venus is audited by Certik. We reviewed the results of this audit for you.

Certik Audit Review of Venus Reward Token

Venus Reward Token (VRT), which is ranked 473rd in the Certik security ranking, is currently on the rise in terms of market capitalization. 86 percent of Certik users marked the token as “Secure”. As a result of the audit, it was reported that there were 4 vulnerabilities, one minor and 3 informational.

| Pull-over-push pattern – minor |

| Visibility specifiers missing – informational |

| Redundant variable initialization – informational |

| Function optimization – informational |

- Certik’s advice is to implement the platform’s pull-over-push pattern, especially for new users.

- In addition, it has been determined that there is an inconsistency in the default visibility settings imposed by Solidity compilers. Certik underlines that this inconsistency can create functionality problems in the code base, and says that the visibility specifier should be set to more explicit.

- Underlining that link initialization statements reduce legibility, Certik recommends removing them from the codebase.

- In the audit, it was determined that the .freeze() and .unfreeze() functions of checking isLocked did not work sufficiently. Certik recommends solving this problem via require statements.

Check the whole security assesment of the token.

Venus Platform Security Measures

Here are the security measurements that are demployed for/by Venus:

- Over collateralization: In order to ensure the security of the Venus network, basically over-collateralization in lending is used. Each block acts as a part of the ledger, and thanks to this decentralized architecture, the management and protection of the entire network is democratic.

- Certik audit report: As with any decentralized platform, there may be some security concerns in Venus due to its unlimited growth potential. One of Venus’ most important responses to these concerns is actually the results of Certik audit. As you can see above, there is no significant vulnerability in the network.

- SWIPE integration: In addition, the fact that the platform works in integration with mediums such as SWIPE creates an extra sense of prestige and security.

- Ethereum Virtual Machine: Binance Smart Chain (BSC) is the ecosystem that provides protocol security. Working with the Ethereum Virtual Machine, supporting the Ethereum Virtual Machine, BSC can continue to operate without downtime even when it is offline or encounters a network issue.

- POSA as a consensus mechanism: BSC also uses a kind of proof-of-stake protocol so that transactions can take place securely on the Venus protocol. This particular protocol, known as POSA, can also be described as a consensus algorithm. The system is a mechanism that operates through proof-of-authority (POA) and proof-of-stake (POS) mechanisms and can perform block additions in a very fast and low transaction fee.

- Automatic liquidation: Venus protocol supplier is also protected by the automatic liquidation process. This system has been developed in order to completely eliminate the risks that may occur in the repayment process of the borrowed money. The system works as follows: if the borrower’s collateral falls below seventy-five percent of the borrowed amount, the collateral is directly seized by the platform. In this way, supplier users who ensure the payment of the debt are not victimized under any circumstances. This allows the min collateralization rate to be stabilized as well.

Lost Money Scandal on Venus Protocol

Of course, security measures do not mean that the platform has never experienced security vulnerabilities before. Perform an important robbery, which was previously called a “historic incident” by crypto money circles, and the full 66 million dollars in an account in the protocol disappeared. After this incident, the protocol lost a total of 77 million dollars worth of money. Venus Protocol, which carried out a detailed investigation of the situation, made great efforts to ensure that the situation was not associated with Venus’ security measurements, was perceived as a one-time event, and took a series of security measures. You can examine the investigation details through the content titled ‘’Incident Post Mortem’’ shared by the site on its own blog page.

Governance in Venus Protocol – Who is in Charge?

Venus Protocol is a system that works completely decentralized and allows its community to control itself. The fact that their advisors and team members do not have pre-mined tokens adds an extra contribution to creating a completely fair ecosystem in the protocol. In this way, all the control of the protocol is left to those who want to mine by finding something promising in Venus Protocol of their own will.

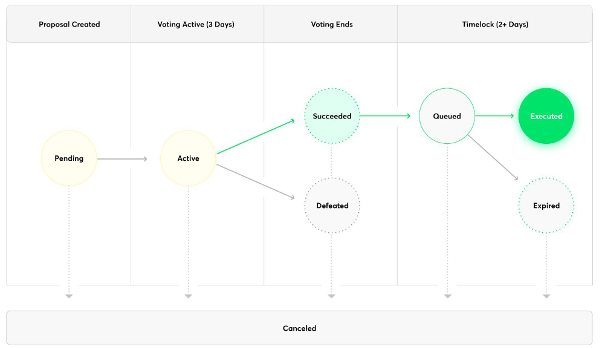

Decisions on the platform are made by voting and proposals can be presented by individuals in the governance. Active voting takes three days, as a result of which it is marked as “succeeded” or “Defeated”. If enough votes cannot be obtained for the proposal, the proposal is canceled. If it can be collected, it can be executed during time lock.

The areas in which the community with the right of governance can create proposals are as follows:

- It may be requested to add a new cryptocurrency or a stablecoin to the protocol.

- It may be requested to define variable interest rates for the Marketplace.

- It can be requested to define fixed interest rates for synthetic stablecoins.

- Voting can be done for any improvement to be made in the protocol.

- It may be requested to delegate protocol reserve distribution schedules.

Have a look at the whitepaper of Venus.io for more.

Is Venus.io Regulated?

No, Venus Protocol is not regulated by any central platform.

Venus Protocol should be considered as a medium that its users manage jointly. It is decentralized and this is what makes both the protocol and the token unique. The fact that it is not centralized and the foundation’s team has not pre-mined significantly reduces the possibility of manipulation and allows the creation of a more democratic commercial space.

A number of protocols are used for the Community to implement the protocol’s governence. In addition, the BEP-20 token is used as the platform’s government token, so the regulation is carried out on a completely democratic basis. Also, the number of tokens in circulation on the platform is limited.

Can I buy XVS with cash?

No, XVS cannot be purchased directly with cash. You can use any of Tether (USDT), Bitcoin (BTC), Binance Coin (BNB), and Binance USD (BUSD) when buying on Binance.

Can I mine XVS?

There is a difference between mining and mining. Mining is based on the principle of solving mathematical problems through powerful computers, and that miner, who reaches the fastest solution, gains the right to add a new block to the chain. Minting is a kind of consensus mechanism and can be defined as the process of validating information. Here, assigning tasks to nodes for validation is sufficient to add a new block to the chain. No need for heavy hardware devices or a problem-solving race. In order for users to mint, it is sufficient to lock their money on the relevant platform.

Venus Protocol is a platform that allows users to mint XVS and offers rewards at certain rates to encourage it.

How to set your Metamask wallet to operate with Venus?

Metamask is actually an Ethereum-based wallet. However, Metamask can also be used on all BSC-based Dapps if its network is set to Binance Smart Chain. The fact that Metamask supports XRV causes many people to prefer this practical wallet that can be added to the search engine as an extension. For this;

Open your Metamask wallet.

Click the hamburger icon and go to Network.

Click on Settings.

Click on ‘Add network’.

Enter the BSC mainnet information in this field.

This information is as follows:

Network Name: Smart Chain

New RPC URL: https://bsc-dataseed.binance.org/

ChainID: 56

Symbol: BNB

Block Explorer URL: https://bscscan.com

Is Venus (XVS) cryptocurrency a good investment in 2022?

According to the market analysis, XVS’s with a 5-year investment, the revenue is expected to be around +389.52%. It is possible to say that the price of Venus is 4.75 USD on 2022-05-15. You can also make the decision by taking a look at the platform’s advantages.